By Kent R. Kroeger (August 3, 2018)

Donald Trump proudly touts 4.1 percent GDP growth in the last quarter, as he should. For advanced economies today, economic growth at that rate is not the norm and rarely sustained.

In Trump’s words, he’s released the American economy from the “shackles of Obama’s of government-worshiping approach” to policymaking where he increased environmental regulations through executive fiat, raised taxes and imposed even more regulations to fund Obamacare, and supported TARP and government spending increases in hopes of boosting an ailing economy coming out of the 2008 worldwide financial crisis.

There is some truth to Trump’s argument and Democrats would be well advised to recognize its merits. But what makes Trump’s booming economy significant is that he tinkers with it while possessing no structured, interconnected understanding of how the economy works. Trump’s policies are a jumbled mess only loosely linked to anything resembling economic theory.

Where establishment Republicans since Ronald Reagan have attracted voters by touting Adam Smith’s classical economics along with its more recent neoclassical synthesis that acknowledges the utility of Keynesian policies for near-term macroeconomic boosts, Trump just throws economic policies against the wall to see what sticks. Some of Trump’s policies are pure classical economics (fewer regulations) while others are right out of Keynes (increased defense spending). Supply-side Trump has stoked disposable income through short-term tax cuts, and boosted business confidence by cutting corporate tax rates. Trump is no ideologue and his economic policies reflect that fact. And Trump the mercantilist shows no fear in starting a potentially growth-killing trade war with not only our greatest adversary — China — but with our closest allies (Canada, European Union).

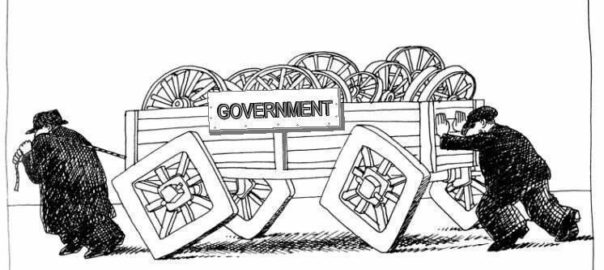

Trump’s intellectual malleability— which is a gentle way of describing it — is filled with internal contradictions that could undercut the economy in rapid fashion. The future debt growth arising from Trump’s tax cuts and massive defense budget increases is staggering. In April 2018, the Congressional Budget Office (CBO) announced its projection for the annual federal budget deficit to exceed $1 trillion in 2020 (see Figure 1).

A $1 trillion deficit during an economic expansionary period!

Imagine what will happen to government spending if a deep recession similar to the financial crisis of 2008 were to occur in the next four years. The neoclassical synthesis school recognizes the need for Keynesian policies in recessionary periods, but when the country is already carrying an annual deficit near $1 trillion, the government’s options become more limited. Sure, we could run the deficit to $2 trillion if we had to, but at some point that approach turns the U.S. into Greece and the major U.S. Treasury debt holders (China, Japan, Ireland, Brazil and Britain) will contemplate putting their money elsewhere.

Figure 1.

Yet, as I am a ‘Chicken Little deficit-hawk’ in the spirit of Senators Rand Paul and Mike Lee, I readily admit predictions of economic doom if we fail to reduce our national debt never materialize.

And when I seek current evidence to support my sky-is-falling worldview, I get this: Moody’s Investor Service’s report in February 2018 ( “Preeminent Financial, Economic Position Offsets Weakening Government Finances”) about the capacity of the U.S. economy to handle our growing national debt. The study is a near total rebuke of small government libertarians.

In the report, Moody’s Investor Service summarized our nation’s current situation: “The stable credit profile of the United States (Aaa stable) is likely to face downward pressure in the long-term, due to meaningful fiscal deterioration amid increasing levels of national debt and a widening federal budget deficit. However, the US economy is very strong, wealthy, dynamic and well diversified, and its role in the global financial system is unmatched. These factors help compensate for the impending fiscal weakness.”

At least Moody’s acknowledges the impending fiscal weakness, which they say will be driven by our country’s rising entitlement costs, rising interest rates, and Trump’s tax cuts.

Still, many factors keep the U.S. from becoming Greece, according to Moody’s report, including our trade competitiveness, rich resource endowment, high income levels and relatively supportive demographic trends.

Yes, President Trump, you read that correctly: supportive demographic trends. There must be some Never Trumpers at Moody’s because their report emphasizes that one of this nation’s greatest advantages over other advanced, slow-growth economies is the significant influx of new immigrants that helps keep our nation’s population growing at a time when others are contemplating losing population over the next 20 years (Japan, Greece, Poland).

Finally, most important to the U.S.’s ability to handle its growing national debt, according to Moody’s report, is the role of the U.S. dollar in global financial markets and the depth and liquidity of the U.S. treasury market. “They insulate the U.S. from external shocks and shifts in financing conditions in a way not seen with other sovereigns,” says the Moody’s report.

While Moody’s shuts up people like myself, I still believe in this economic maxim: All else equal, economies perform better when guided by free markets and lower levels of government intrusion.

What reinforces my belief in small government are charts like the following that I created using data from The Heritage Foundation’s 2018 Index of Economic Freedom report.

Freedom and limited government are strongly associated with economic growth

For over 20 years now, The Heritage Foundation, a free market, conservative-leaning think tank, has been quantifying the levels of economic freedom across the globe.

“Economic freedom is a critical element of human well-being and a vital linchpin in sustaining a free civil society. As the Index of Economic Freedom catalogues, the best path to prosperity is the path of freedom: letting individuals decide for themselves how best to achieve their dreams and aspirations and those of their families,” write Terry Miller, Anthony B. Kim and James M. Roberts in the introduction to The Heritage Foundation’s 2018 Index of Economic Freedom report.

The 2018 Index of Economic Freedom (IEF) grades and ranks countries on 12 measures of economic freedom that evaluate the rule of law, government size, regulatory efficiency, and the openness of markets. A complete description of the 2018 IEF methodology can be found here.

My innovation to the 2018 IEF data set was to reduce the 12 measures of economic freedom down to four (Business Freedom, Gov’t Integrity, Freedom from Gov’t, and Fiscal Integrity) through a principle components analysis which is available upon request.

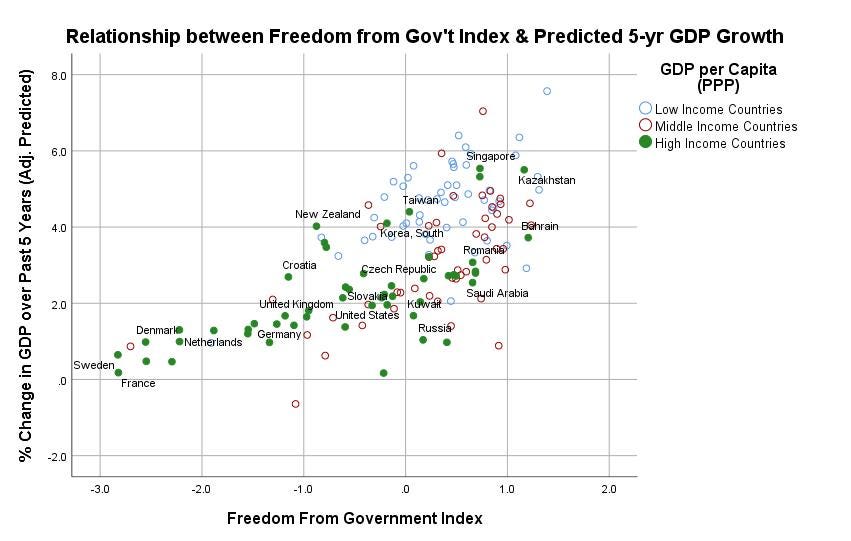

Of particular interest are the Business Freedom and Freedom from Government factors as they were strongly associated with 5-year GDP growth across all of the models tested.

The Business Freedom factor measures a country’s regulatory and infrastructure conditions that impact the ease of starting, operating, and closing a business.

The Freedom from Government factor has two major components. The first measures a country’s tax burden in terms of marginal tax rates on both personal and corporate income and the overall level of taxation (including direct and indirect taxes imposed by all levels of government) as a percentage of gross domestic product (GDP). The second component reflects the burden imposed by government expenditures, which includes consumption by the state and all transfer payments related to various entitlement programs.

I also added these variables to the data set:

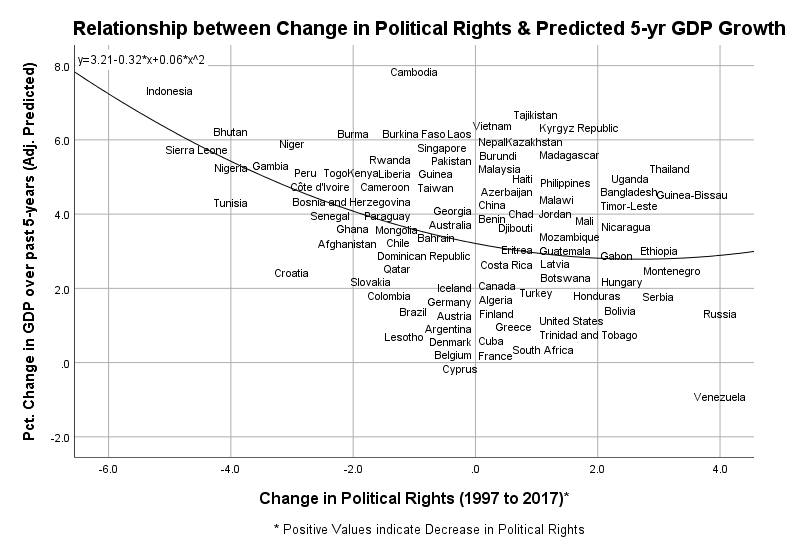

(1) Freedom House’s 1997 and 2017 Index of Political Rights to test the association of political freedoms and institutions with economic growth. This variable is coded on a 1 to 7 scale where 1 equals the highest level of political rights and 7 equals the lowest level of political rights.

(2) The economic cost of violence as a percent of GDP (as measured by the Institute for Economics and Peace).to control for the effects of war and domestic violence on a nation’s GDP growth.

Finally, my dependent measure was the 5-year GDP growth for each country from 2013 to 2017 (Source: World Bank) and the linear model generated using SPSS software is in the Appendix.

RESULTS:

As I am using a cross-sectional model to investigate the relationship between GDP growth and economic freedom, I am not able to draw strong conclusions about the direction of the causal relationships or how those dynamics change over time and in different economic contexts. It should also be noted that the 2018 IEF dataset occurs within a general period of economic expansion across the globe.

Nonetheless, while I do not pretend that the following results prove anything, they give us a snapshot at one point in time about the economic relationships between freedom and GDP growth.

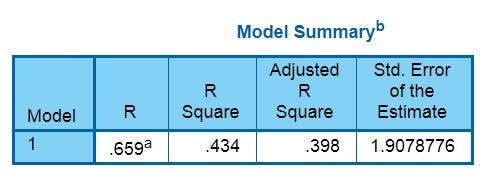

Overall, the linear model explained about 40 percent of the variation in 5-year GDP growth (R-squared = 0.398) with the parameter t-tests for the following independent variables achieving significance at the p<.05 level (95% confidence level):

⚫ Business Freedom factor (standardized beta = 0.233): More business freedom associates with higher GDP growth

⚫ Freedom from Government factor (standardized beta = 0.226): Greater freedom from the government’s intrusion in the economy associates with higher GDP growth

⚫ An indicator variable for Asian Pacific countries (standardized beta = 0.258): Being an Asian Pacific country (the “Asian Tigers”) associates with higher GDP growth

⚫ Economic cost of violence as a percent of GDP (standardized beta = -0.216): Violence due to wars associates with lower GDP growth

⚫ Natural log of GDP per capita (standardized beta = -0.408): High-income countries associates with lower GDP growth

⚫ Index of Political Rights in 2017 as measured by Freedom House (standardized beta = 0.228): Lower levels of political freedom associates with higher GDP growth (This finding may sound counter-intuitive but it is consistent with the political science literature which has found the relationship between the political rights and GDP growth is curvilinear such that countries in the middle of the political rights scale tend to have the highest growth rates. In future analyses of these data I will explicitly model the relationship as curvilinear as opposed to the linear specification reported here)

⚫ Change in Index of Political Rights from 1997 to 2017 as measured by Freedom House (standardized beta = -0.193): Countries gaining in political freedom between 1997 and 2017 associates with higher GDP growth

The first graph (Figure 2) shows the relationship between the Freedom from Government factor and the predicted 5-year GDP growth. Interesting to note in the graph is how low-income countries tend to have higher predicted GDP growth. Also interesting is that the linear relationship between the Freedom from Government factor and predicted GDP growth is still strong when filtering down to only high-income countries (the green dots). It is apparent that the “Asian Tiger” countries (South Korea, Singapore, Taiwan, etc.) predominate among the high-income countries with strong predicted GDP growth. No surprise there.

Figure 2.

The second graph (Figure 3) shows the relationship between the change in the Index of Political Freedom (1997 to 2017) and the predicted 5-year GDP growth. Interesting to note in this graph are the countries where political freedoms declined over the 20-year period (Russia, Serbia, Venezuela, Hungary, etc.) also have lower predicted GDP growth. Conversely, countries where political freedoms increased (as many in Africa did), predicted GDP growth was higher (Indonesia, Tunisia, Nigeria, Gambia, Niger, Sierra Leone, etc.).

Figure 3.

The takeaway is that economic and political freedom really does matter. The ability to start and operate a business without excessive government intervention aids in a country’s economic development. The more government takes from the economy (taxes) and competes for resources (gov’t spending), the lower the growth prospects for a country.

That sounds like a message right out of the Ronald Reagan playbook.

This is not an argument against all government spending. Governments are vital when ‘tragedy of the commons’ and other sub-optimal results occur in free market environments. And in the provision of many vital services and functions — such as health care, education, and national security — governments are often more efficient and economically rational than the private sector.

It is economically plausible that a Medicare-for-All health care system in the U.S., such as the one as proposed by Vermont Senator Bernie Sanders, would eat fewer financial resources than the current ‘mostly private’ system while also providing better outcomes. A recent study by the Mercatus Center (George Mason University) provides tentative evidence of this possibility, though critics of a Medicare-for-All system are quick to point out that many strong assumptions in the Mercatus study would need to be realized for Medicare-for-All to save the nation money.

Therefore, a general belief in the power of free markets to unleash a nation’s economic potential should not be translated to mean every social function has to be met by an unfettered private sector. Our expensive and ineffective U.S. health care system is living proof that free enterprise has its limits.

Trump has jettisoned the GOP’s ‘small government’ narrative

For my entire adult life, the Republicans have carried the following message to the voters at every level of elected office: Less government is better government; lower taxes, fewer regulations will unleash the power of free markets.

The Republicans’ franchising of this simple message over the past 40 years may well account for their current dominance at all levels of government.

In describing the Republican’s rise to political dominance, starting with Ronald Reagan’s 1980 election victory, Brown University political scientist James Morone wrote:

“The great conservative narrative of American decline-a formidable Puritan jeremiad with all the trimmings-routed the Democrats, who promised only more efficient government and more expansive benefits. Conservatives smeared national health insurance as another big-government, something-for-nothing program aimed at the wrong people-the poor, the failed, and the lazy. Republicans soon converted the backlash into a “Contract with America” and seized control of government by winning the House, the Senate, both legislative chambers in eleven new states, and-over three years-fifteen new governors’ offices. Conservatives have been tightening their grip on power ever since.”

In Morone’s view, the Republican’s have ridden their big government is the enemy trope into power and maintained their political dominance at all levels of government because Democrats and progressives have never countered with equally coherent, grand vision. Democrats and progressives are good at offering policies and solutions to address problems, but that strategy, according to Morone, only reinforces the germaneness of the Republican’s pre-Trump narrative.

It’s not like Democrats haven’t possessed opportunities to turn the GOP’s own ‘anti-government’ sentiments against them given, since World War II, the GOP while in control of the executive branch has never decreased the size of government.

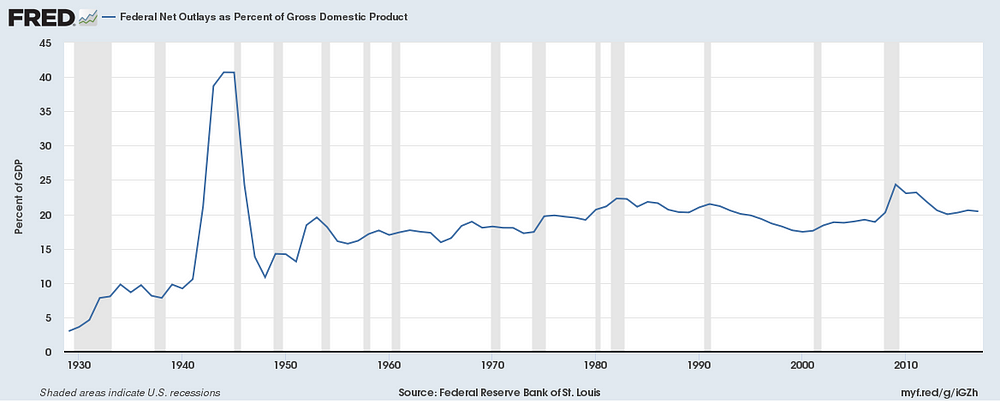

Ironically, it took a Democrat to translate the GOP’s ideas into reality. In Bill Clinton’s last year in office, the federal payroll, when measured relative size to the total U.S population, had almost 25 percent fewer civilian employeeswhen compared to 1992. Similarly, direct federal expenditures under Clinton held constant during his presidency, going from $5,694 per American in 1992 to $5,647 per American in 1999 (when measured in constant dollars). When measured as a percent of gross domestic product, federal net outlays under Clinton fell from 21 percent to 17 percent (see Figure 4).

Figure 4.

Clinton was so confident in his belief that his “New Democrats” had discovered the secret sauce in striking a balance between the necessary size of government and robust economic growth, he declared in his 1996 State of the Union address that “the era of big government is over, but we cannot go back to the time when our citizens were left to fend for themselves.”

As I often quote my father as saying about Bill Clinton, ‘He was the greatest Republican president we’ve ever had.” He wasn’t saying it as a compliment, however; but I now believe, as a libertarian with progressive tendencies (or am I a progressive with libertarian tendencies?), the post-Clinton presidencies squandered an opportunity to put the federal government on a sound fiscal path that could have lasted through the 21st century.

Democrats and Republicans have colluded to make the American economy a permanent war economy

If Clinton’s fiscal model had been pursued through today —smaller government, higher taxes on the wealthy, targeted tax cuts, broad deregulation, and limited military commitments — this country would be in a better financial position to consider substantive policy ideas to address global warming, terrorism, student debt, slow wage growth, and a more rational health care system.

Instead, our country today is too busy funding the occupations of Afghanistan and one-third of Syria, supporting a regime change war in Yemen, threatening new regime wars in Iran and North Korea, and maintaining military bases and special operations forces in over 150 countries, to seriously consider implementing progressive policies such as an economically rational health care system comparable to what EVERY advanced economy in the world already enjoys.

In the shadow of the Trump administration, it is very sheikh in intellectual circles to reevaluate George W. Bush’s legacy as not being as bad as we once thought. The rehabilitation of W. is what happens when corporate Democrats join forces with neocons like Bill Kristol and David Frum in a common struggle to remove Donald the Barbarian from power.

In point of fact, the cost of George W. Bush’s incompetence continues to grow by the day. The hope that Barack Obama would end Bush’s interventionism never materialized — instead, he maintained most of the U.S.’s military commitments abroad and, often at the urging of his Secretaries of State, found new ones (Libya, Syria, Yemen, and half of the African continent).

The ink and airtime spent in the last two years by the news media over Russia’s crude meddling in the 2016 election is a convenient distraction so establishment Democrats and Republicans won’t be held accountable for their failed foreign policy policies and unsustainable military interventions over the nearly past 20 years. The radical Islamic terrorism whose seeds were planted by the First Gulf War in 1991 but isolated geographically in Middle East, now finds sanctuary from Southeast Asia to Northern Africa and has planted roots in many of Europe’s largest urban centers.

Our Middle East regime change wars create more problems than they solve through the killing and dislocating of millions of civilian noncombatants, destabilizing social institutions, inflaming centuries-old conflicts, and increasing the regional influence of America’s competitors like Russia and Iran.

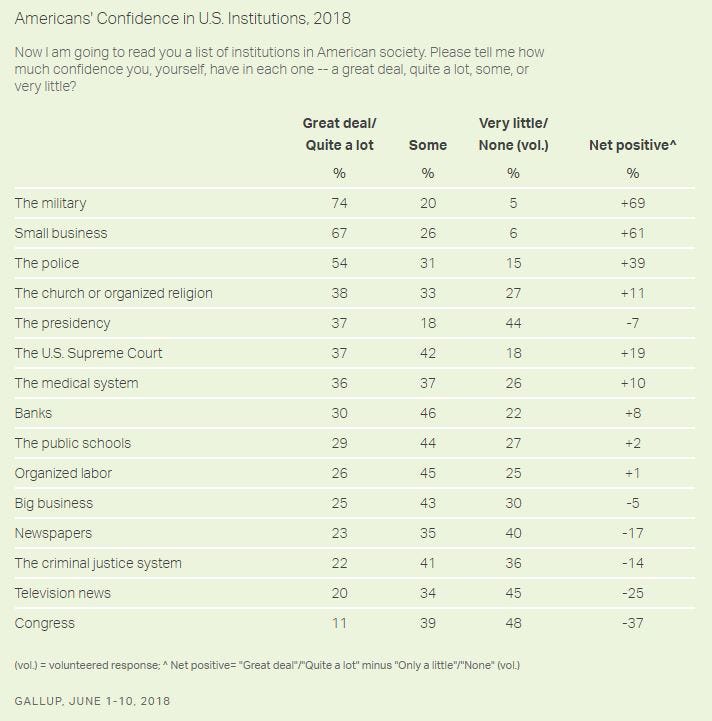

Why are newspapers and TV news among the least trusted institutions in America? Because they fail to address the issues that matter most to people. Russia doesn’t keep 30 million Americans without health insurance. Russia doesn’t saddle college students with debt that will take some most of their adult life to pay off. Russia isn’t warming the planet to where forest fires, droughts and urban flooding are no longer newsworthy but the norm (oh wait, Russia is actually part of that problem…but no more culpable than we are).

Figure 5.

The media-fanned Russia scare looming over America today has set this country back on a whole host of important issues. Two years have been lost and there is no reason to believe we won’t lose the next two as well.

As long as the mainstream media continues to profit from fulminating at every word out of Donald Trump’s mouth and trying to convince Americans that Russia and Trump are existential threats to our democracy (they aren’t), as a nation, we are avoiding the real conversations that need to be going on regarding our counterproductive military entanglements and the more pressing domestic issues such as an over-priced health care system, student debt, and stagnant incomes for half of the country.

But nothing demonstrates the feckless and banal content of today’s news media than their uncritical coverage of American’s pursuit of regime change wars across the globe.

The crass cynicism of the corporate media and its unapologetic shilling for the nation’s military-industrial interests is perfectly captured in this discussion between CNN’s Wolf Blitzer and U.S. Senator Rand Paul (R-KY) over America’s continued military support to Saudi Arabia in its proxy with Iran in Yemen’s civil war.

Wolf, you muttonhead. You are not supposed to say out loud, ‘We can’t end our substantial role in this tragic war in Yemen because it will hurt American jobs.’

Wolf, sometimes you are a total imbecile.

That some Americans disproportionately profit from the American war machine is not new but it is always news.

Marine Corps Major General Smedley Butler, one of two Marines to receive Congressional Medals of Honor for two separate acts of heroism, said it first in 1935 and it still applies today: “A few profit — and the many pay. But there is a way to stop it. You can’t end it by disarmament conferences. You can’t eliminate it by peace parleys at Geneva. Well-meaning but impractical groups can’t wipe it out by resolutions. It can be smashed effectively only by taking the profit out of war…”

Six companies control 90% of U.S. media

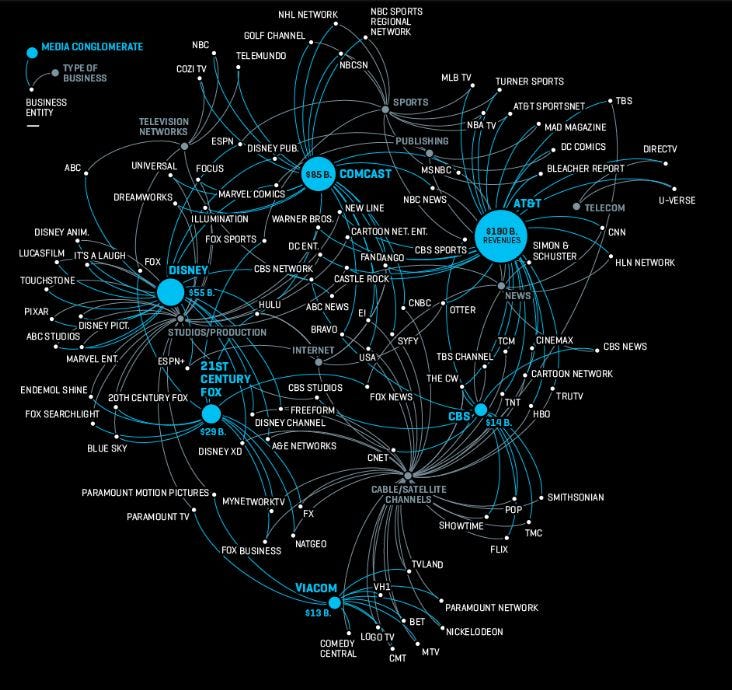

And who is front and center supporting (and profiting) from the military-industrial complex? Comcast. AT&T. Disney. 21st Century Fox. Viacom. CBS.

Just six companies, for all practical purposes, control the media you consume. Thirty years ago it would have been 50 companies controlling 90 percent of the U.S. media.

This is a problem with, not a virtue of free market capitalism.

Figure 6.

Animal species depend and thrive on genetic diversity. It helps them avoid going down some potentially unfortunate genetic cul-de-sacs.

For example, when too much inbreeding occurs, this is what you get:

Charles II (1661–1700) was the son of Philip IV of Spain and his second wife, Mariana of Austria. Quite unfortunately, Philip and Mariana were uncle and niece to each other, making Charles, their son, also their great-nephew and first-cousin respectively. Hence, the Habsburg jaw.

As a child, Charles did not talk until the age of four or walk until eight and was considered, using the terminology of the day, an total imbecile. He nonetheless rose to throne in 1665 and reigned for five torturous years.

In Charles II of Spain, I can’t think of a better analogy to represent today’s American news media — inbred, lame, unteachable, yet still dangerous.

The U.S. democracy is under threat, but it is not from the Trumps or the Russians. And while both can do harm to this country, their threat pales in comparison to a national news media that is hopelessly biased, incurious, frequently inaccurate, impertinent and generally not trusted by most Americans.

-K.R.K.

About the Author: Mr. Kroeger is a survey and statistical consultant with over 30 -years experience measuring and analyzing public opinion. He currently lives in New Jersey with his wife and son (You can contact him at: info@olsonkroeger.com or at kroeger98@yahoo.com)

APPENDIX: Linear Model Predicting 5-year GDP growth rates for 154 countries (2013–2017)